Beyond 5-Star Reviews: How to Command Premium Prices

If you’re running a well-reviewed HVAC, plumbing, or electrical company but still feel constant pressure to discount or justify your pricing, the problem isn’t your reputation. It’s that reviews no longer create meaningful separation. This article explains why five-star ratings have become table stakes, and what actually allows home service companies to command higher prices.

When Everyone Has Great Reviews, Nobody Stands Out

Open Google Maps and search for HVAC contractors, plumbers, or electricians in your market. Count how many have ratings above 4.5 stars. In most markets, it’s nearly all of them.

Now ask yourself: if you and your top five competitors all have excellent reviews, what exactly do those reviews differentiate?

Nothing. That’s the uncomfortable answer.

Five-star reviews have become the participation trophy of home services marketing. Twenty years ago, a strong review profile set you apart. Today, it just means you showed up and did your job without causing problems.

The customer who reads your 4.8-star rating and then checks your competitor’s 4.7-star rating isn’t going to pay you 30% more based on that difference. They can’t even perceive a meaningful difference.

This is the trap most home service companies fall into. They obsess over collecting reviews because that’s what they’ve been told matters. They hit 200 five-star reviews and wonder why they’re still competing on price against the company down the street with 180.

The answer is simple: reviews have become table stakes. They’re the minimum requirement to be considered, not the reason to be chosen.

Building a premium home service brand requires moving beyond what everyone else is doing and into territory that actually creates separation.

Table Stakes vs. True Differentiation

Table stakes are the things customers expect from any competent service provider. They’re necessary, but they don’t justify premium pricing because they’re not distinctive.

In home services, the list of table stakes has grown substantially over the past decade.

Reviews above 4.5 stars? Table stakes. Licensed, bonded, and insured? Table stakes. Background-checked technicians? Table stakes. Showing up when you say you will? Table stakes. Clean trucks and uniformed crews? Table stakes. Responding quickly to inquiries? Table stakes.

None of these create pricing power because none of them are rare.

Every serious competitor in your market either has them or is actively working on them. When you lead with these credentials in your marketing, you’re essentially announcing that you meet the minimum requirements.

That’s not premium positioning. That’s parity.

True differentiation lives in a different space entirely. It’s not about being competent. It’s about being meaningfully distinct in ways your competitors can’t—or won’t—replicate.

The Brand Equation Most Contractors Get Wrong

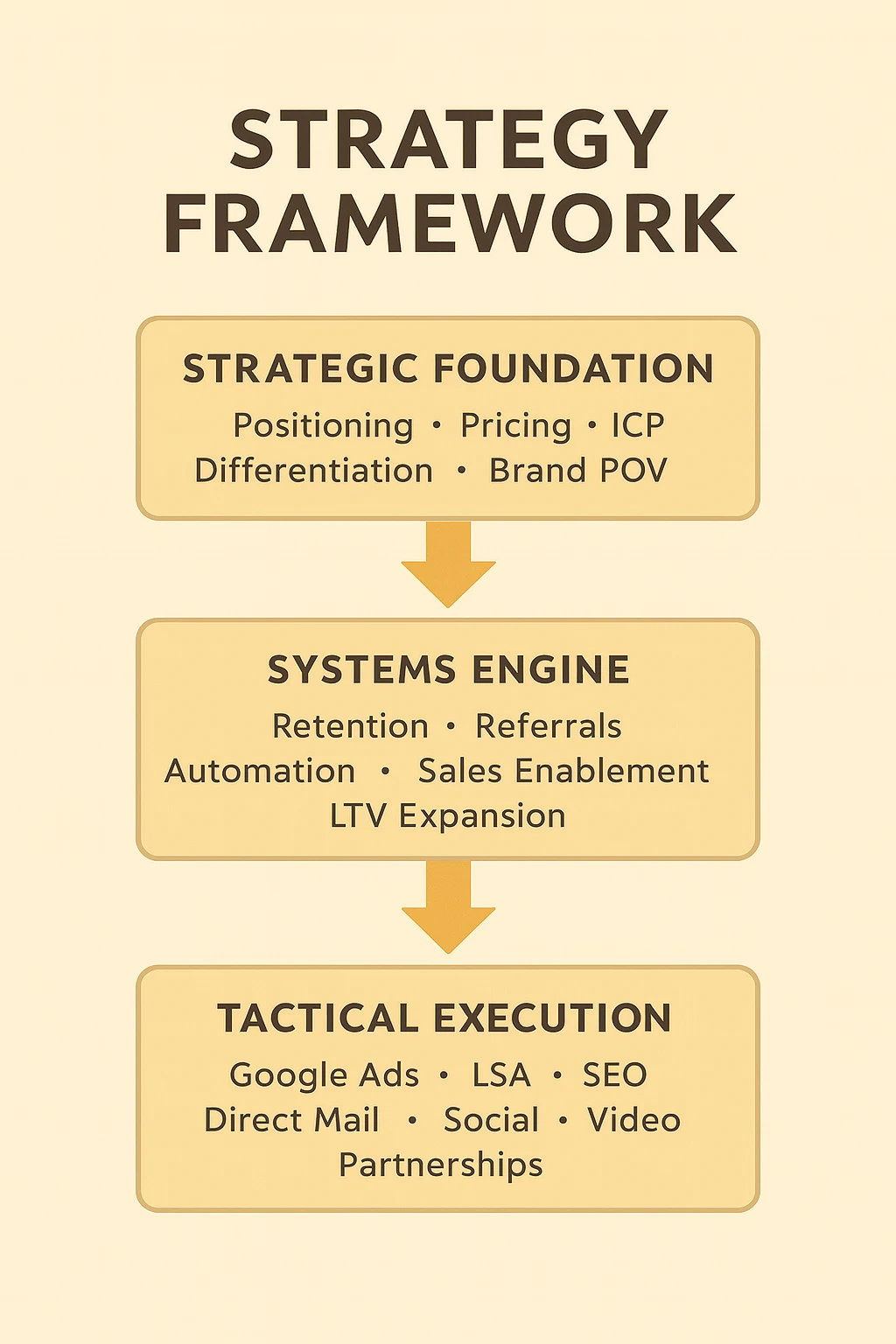

Most home service companies approach branding backward. They start with tactics—logos, truck wraps, uniforms, websites—and hope those surface-level elements somehow create a premium perception.

But branding isn’t a coat of paint you apply to your business. It’s the accumulated experience customers have with your company at every touchpoint.

A premium brand isn’t built through design choices alone. It’s built through strategic decisions about how you operate, who you serve, and what you’re known for beyond the basic service you provide.

Consider two HVAC companies.

Company A has a polished website, professional truck wraps, and a clean logo. They offer heating and cooling services to anyone who calls. Their marketing emphasizes their 4.9-star rating, fast response times, and “quality workmanship.”

Company B looks just as professional. But they’ve built their business around a documented, named diagnostic process. Their technicians are trained to explain not just what’s wrong, but why it happened and how to prevent it from happening again. They specialize in older homes with known HVAC challenges. Their follow-up system reaches out proactively before seasonal peaks.

When customers describe Company B to friends, they don’t say “they were good.” They describe specific experiences.

Company B charges roughly 25% more, and closes at higher rates. Not because their trucks are shinier, but because their brand is built on differentiated experience rather than aesthetic similarity.

The Four Dimensions of Premium Brand Building

Premium positioning is built across four interconnected dimensions: how you deliver service, what you know, how customers experience you, and who you intentionally serve.

Most companies focus on only one or two. That’s why they struggle to escape price competition despite having a “nice brand.”

Proprietary process is the first dimension. This means developing documented, named systems that define how you deliver service. A 15-Point Safety Inspection. A Comfort Assurance Protocol. A Same-Day Resolution Process.

The key isn’t inventing new technical procedures. It’s codifying what you already do well in ways customers can understand, remember, and reference when recommending you.

Demonstrated expertise is the second dimension. Reviews say you did good work. Demonstrated expertise shows you understand things other contractors don’t.

This might mean educational content tailored to specific systems, specialization in certain home types, or diagnostic capabilities that go beyond surface-level problem identification. The goal is to create the perception—backed by reality—that you know things others don’t.

Experience architecture is the third dimension. This includes every interaction a customer has with your company, from their first website visit to post-service follow-up.

Premium brands don’t leave these moments to chance. They design them. The confirmation text that introduces the technician by name. The explanation approach that educates rather than overwhelms. The follow-up that feels intentional instead of automated.

Market positioning is the fourth dimension. This defines who you’re for, who you’re not for, and how clearly that distinction comes across.

Premium brands don’t try to appeal to everyone. They’re willing to lose price-sensitive customers to win quality-focused ones. They position themselves against the budget option instead of competing with it.

Why Reviews Can’t Do the Heavy Lifting

Reviews function as social proof. They tell prospects that other people had acceptable experiences.

But social proof only creates advantage when it’s scarce.

When every competitor has hundreds of positive reviews, the proof becomes meaningless. You’re all socially validated. Now what?

Here’s what reviews actually tell a homeowner: you probably won’t have a terrible experience.

That’s useful information. It’s just not pricing power.

Premium pricing requires answering a different question. Not “will I be satisfied?” but “why should I pay this company more than the others who would also leave me satisfied?”

Reviews can’t answer that question. They speak to baseline competence, which is now expected.

Maintain your review strategy. Just stop expecting it to elevate you.

Building Proof That Actually Differentiates

Most companies think proof means testimonials. Premium brands know proof means documentation.

Case studies that detail specific problems, diagnosis, and outcomes demonstrate differentiation far more effectively than generic praise. They show how you think, not just that customers liked you.

Visual documentation—before, during, and after—lets prospects see complexity, care, and execution quality that reviews can’t capture.

Third-party validation beyond customer reviews adds credibility. Manufacturer recognition, specialized certifications, media features, and speaking roles all signal that people other than your customers consider you exceptional.

Educational content that consistently teaches homeowners positions you as an authority, not just a provider. This kind of differentiation can’t be replicated with marketing language alone.

The Brand Compounding Effect

Brand building compounds in ways tactical marketing never will.

Ads work while you pay for them. When you stop, the results stop.

Brand investments accumulate. Each case study adds to your proof library. Each piece of educational content strengthens your authority. Each refined customer interaction improves your experience architecture.

The contractor who starts building a differentiated brand today will have an advantage in three years that competitors can’t close by copying tactics.

Not because they’ll have more reviews, but because they’ll have built something durable.

Escaping the Review Treadmill

Many home service companies are stuck on the review treadmill. Every month they collect more. Every month their competitors do too.

The treadmill keeps moving. Nobody gets ahead.

Reviews are maintenance, not advancement.

Dropping below expectations hurts you. Rising above them requires brand-building work that reviews can’t accomplish.

The Premium Brand Audit

Assess honestly where you stand across the four dimensions.

Do you have documented processes customers can reference? Are you perceived as an expert or just competent? Are your touchpoints intentionally designed? Do you clearly know who your ideal customer is?

The gap between your answers and premium pricing is the work.

The Brand Building Commitment

You don’t need to be exceptional across all four dimensions to command higher prices. You need to be genuinely strong in one or two and competent in the others.

Start where you already have momentum. Codify it. Prove it. Build around it.

The alternative is continuing to collect reviews alongside your competitors and wondering why your prices stay flat while your ratings climb.

Five-star reviews prove you’re competent. A premium brand proves you’re worth more.

Beyond 5-Star Reviews: How to Command Premium Prices Read More »

You’ve hired multiple marketing agencies over the years. Each one promised “more leads,” “better SEO,” and “game-changing campaigns.” Yet you’re still

You’ve hired multiple marketing agencies over the years. Each one promised “more leads,” “better SEO,” and “game-changing campaigns.” Yet you’re still