How to Generate Predictable Recurring Revenue

According to ACCA, recurring service agreements now represent over half of HVACR industry revenue, underscoring their importance in stabilizing cash flow and customer relationships.

Yet in spite of this, most HVAC and plumbing companies spend aggressively to acquire customers, then act surprised when they have to acquire the same customer again 18 months later.

You invest $300–$500 to generate a lead. You complete a $2,800 job. Then when that homeowner needs service again, they Google “HVAC repair near me” or “plumber near me” and enter someone else’s funnel.

Membership programs change the economics entirely.

Instead of repeatedly paying to reacquire the same customer, you build a recurring revenue system that increases lifetime value, improves close rates, and reduces customer acquisition costs over time.

In established $2M–$10M home service companies, properly structured membership programs routinely generate $100,000 to $300,000 in annual recurring revenue while reducing paid acquisition dependency by 30–40%.

This isn’t a marketing campaign. It’s revenue infrastructure.

Why HVAC & Plumbing Membership Programs Outperform Traditional Service Agreements

Service agreements have existed in the trades for decades. Most underperform because they are structured as operational products rather than strategic marketing assets.

A true membership program is built around three financial objectives:

- Recurring revenue generation from monthly or annual fees

- Increased service frequency from members who call you first

- Higher replacement close rates due to ongoing trust

The difference is positioning. Service agreements focus on preventing breakdowns. Membership programs focus on preventing customers from ever considering your competitors.

Across mid-sized HVAC and plumbing companies, membership customers typically generate 2–3x more lifetime revenue than transactional customers while exhibiting significantly lower price sensitivity.

“Industry data shows acquiring a new HVAC customer can cost 5× more than retaining an existing one, and improving retention by just 5% can raise profits by up to 95%.”

The Revenue Architecture of Effective Membership Programs

High-performing membership programs generate revenue from three distinct streams.

1. Membership Fees (Recurring Revenue Base)

For HVAC companies, pricing commonly ranges from $19 to $35 per month. Plumbing programs often range from $15 to $29 per month depending on benefits and market positioning.

At 400 members paying $25 per month, that equals:

- $10,000 per month in recurring revenue

- $120,000 annually before additional work

This smooths seasonality and stabilizes cash flow.

2. Increased Service Call Frequency

Members call you first. They do not price shop at the same rate as non-members.

With 400 members generating an average of 2.5 service calls per year, that equals 1,000 service calls captured without paid acquisition.

If your cost per acquired service call is $75–$120, that represents $75,000–$120,000 in avoided marketing spend annually.

3. Higher Replacement Approval Rates

Ongoing maintenance builds trust. Trust increases close rates.

When replacement recommendations occur inside an established relationship, approval rates are often 20–40% higher than cold estimates.

The compounding effect over three years dramatically shifts company economics.

Why Membership Programs Reduce Customer Acquisition Costs

Customer acquisition cost (CAC) reduction happens through three mechanisms:

1. Members Exit the Paid Acquisition Funnel

Members don’t click Google Ads when equipment fails. They call you directly.

Each member who calls you directly represents avoided bidding competition and avoided ad spend.

2. Referral Quality Increases

Member referrals close at significantly higher rates than cold traffic. Referred leads commonly convert at 60–70% compared to 20–30% from paid channels.

3. Revenue Stability Reduces Desperation Bidding

Companies with 30–40% of revenue tied to membership and member-generated work are less reliant on peak-season PPC bidding wars.

This creates a competitive advantage in mid-sized markets where digital ad costs spike during extreme weather events.

How Membership Programs Support Premium Pricing

Membership models reduce price sensitivity because they shift the relationship from transaction to partnership.

Members perceive:

- Priority access

- Insider pricing advantages

- Ongoing protection

- Reduced risk

When equipment replacement discussions occur inside that relationship, the focus shifts from “price comparison” to “solution trust.”

This is why companies with mature membership bases often sustain 20–40% price premiums while maintaining strong close rates.

Structural Elements That Drive Enrollment

Enrollment success depends more on structure than marketing budget.

Keep Benefits Simple

Three core benefits outperform twelve minor perks.

For HVAC:

- Priority scheduling during peak season

- Annual precision tune-ups

- Member-only repair discounts

For Plumbing:

- Annual plumbing inspection

- Drain maintenance credit

- Emergency response priority

Lead With Monthly Billing

$24.95 monthly converts significantly higher than $299 annual, even when annual represents better value.

Technician Enrollment Drives Growth

In-home enrollment typically accounts for 60–70% of total memberships.

Companies that train every technician to present membership after every service call enroll 3–5x more members than companies that rely solely on email or website promotion.

Financial Modeling: A Three-Year Projection

Year One

- 120–200 members

- $30,000–$50,000 ARR

Year Two

- 280–360 members

- $70,000–$95,000 ARR

- Increased member service revenue

Year Three

- 480–620 members

- $125,000–$165,000 ARR

- Total revenue impact exceeding $300,000

These projections assume 80–85% annual retention and consistent technician enrollment systems.

Retention Systems That Protect Lifetime Value

Retention determines profitability.

Programs with 85% retention behave fundamentally differently than programs with 60% retention.

Automated Maintenance Scheduling

Members should never have to remember to book their tune-up.

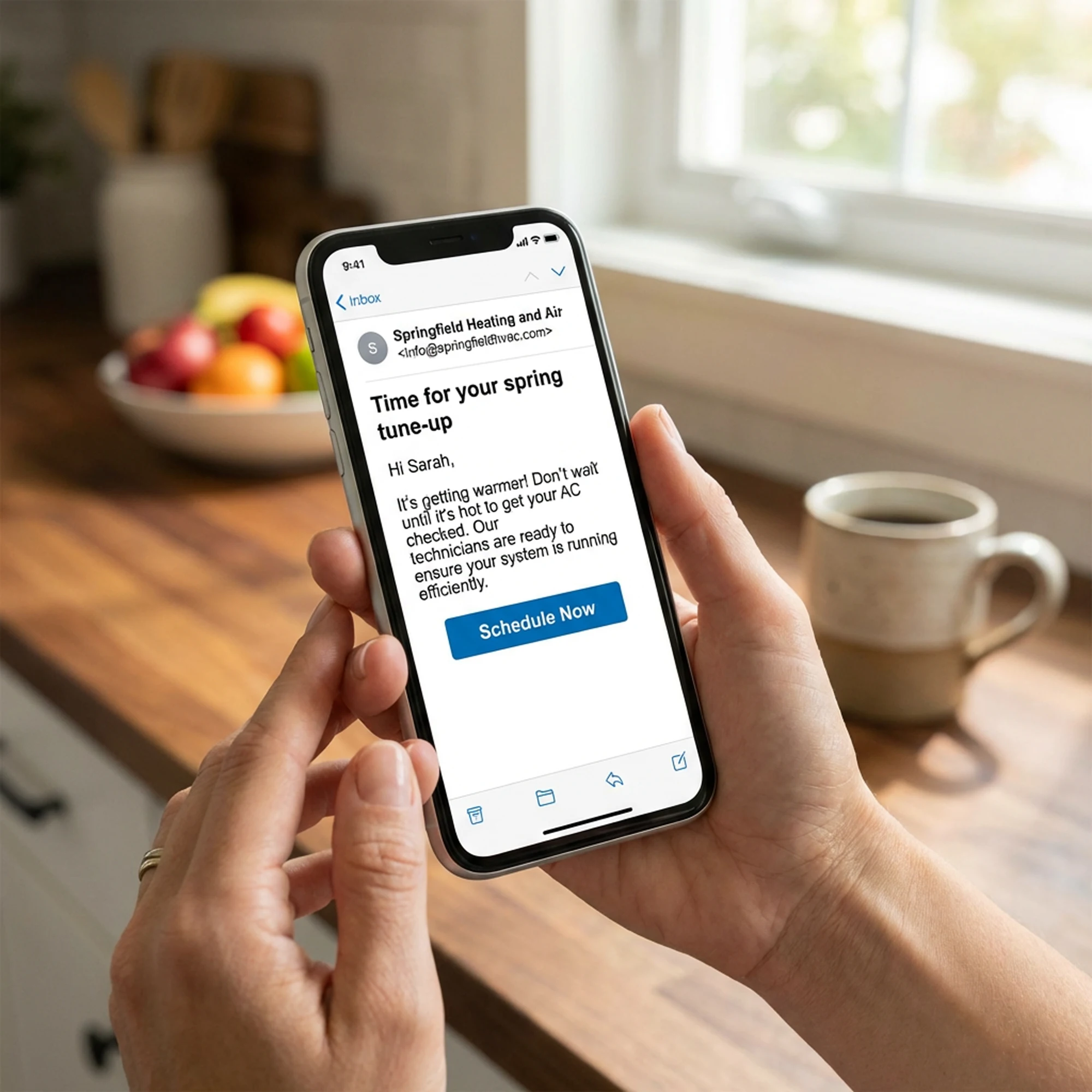

Ongoing Communication

Monthly or quarterly member communication increases renewal rates by keeping value visible.

Automatic Renewal Billing

Credit card auto-renewal produces significantly higher retention than invoice-based renewal systems.

Common Mistakes That Sabotage Membership Growth

- Overcomplicating tiers and pricing

- Failing to train technicians on enrollment

- Underpricing to “get more members”

- Tracking only membership fee revenue instead of total member revenue

- Ignoring retention metrics

Membership growth is not a marketing trick. It is an operational discipline.

Frequently Asked Questions About HVAC & Plumbing Membership Programs

How many members does an HVAC company need to see meaningful revenue?

Most companies begin seeing material financial impact around 250–300 active members. Significant compounding effects occur beyond 400 members.

What is the average HVAC membership retention rate?

Well-structured programs typically achieve 80–90% annual retention when maintenance scheduling and billing systems are automated.

Should HVAC memberships be monthly or annual?

Monthly billing converts at significantly higher rates. Many companies offer both but lead with monthly enrollment.

Do plumbing companies benefit from membership programs?

Yes. Plumbing memberships drive preventative visits, emergency call preference, and increased water heater replacement close rates.

Are membership programs effective in smaller markets?

In smaller to mid-sized markets, membership programs often perform better because brand familiarity and relationship equity carry greater weight.

Your First 90 Days

Days 1–14: Define three core benefits, set pricing between $19.95–$29.95 monthly, select billing software.

Days 15–30: Train technicians, establish enrollment incentives, role-play objection handling.

Days 30–60: Launch to existing customer database via email and direct mail.

Days 60–90: Optimize technician enrollment and monitor retention metrics.

Final Perspective

Membership programs represent one of the most reliable paths to predictable recurring revenue in HVAC and plumbing businesses.

They increase lifetime value, reduce acquisition dependency, and make premium pricing easier to sustain.

The model works. The compounding economics are well established.

The real question is whether you are willing to build the systems required to reach critical mass — and maintain them for 18–24 months until the financial advantages become undeniable.

For companies willing to execute consistently, 400+ members generating $150,000+ in predictable annual revenue is not aggressive. It is achievable.

The revenue is already inside your customer base. Membership simply captures it systematically.